Members enjoy access to exclusive conferences and events where they have the opportunity to meet like-minded people. But most importantly, our members have access to some of the most sought after early-stage investment opportunities in the world. All of the companies invited to raise capital on our platform have been through a rigorous vetting process with our investment team, and all of our selected founders have a vision to build high-growth, scalable businesses.

Take control of your venture portfolio and

back the founders you believe in.

Leadership for local Venture Communities.

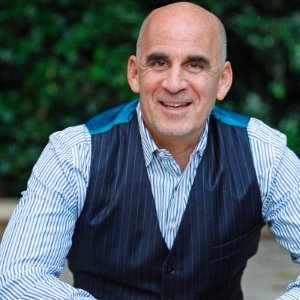

George Vukotich, Ph.D. is the Founding Venture Partner – Chicago for 1000 Angels. In this role he works with investors to bring them together to evaluate a unique set of opportunities exclusive to 1000 Angels. He is an accredited investor and works with one of the largest high-tech incubators in the world helping over 350 startup companies with mentoring and access to educational and developmental opportunities. He has been involved in three startups and has an extensive background in working with startups. His background also includes working with large firms such as IBM and Accenture. He has been a dean of a college of business and taught at the graduate and undergraduate level. In addition he recently completed 28 years of service with our Air Force, is on the board of a children’s organization, and is working on his fourth book; Mentoring in a Startup Environment.

Lead the efforts of a local chapter of 1000 Angels in your region.

Director of Equity Research and Investor for two decades with leading organizations including UBS and SoundView Technology Group. Since 2004 Mr. Kris Tuttle has been running his own firm focused on technology research, advisory and investing – mostly in emerging companies. His first direct private investment was CapeClear in the late 1990’s. Two large rounds later it was acquired by WorkDay. Since then he has been the founding investor in GoodData which is a leader in software analytics. In addition to a bevy of smaller companies and syndicates, he invested in CoFoundersLab.com which is now part of Onevest. He has also been an LP in some established VC platforms but prefers the direct approach. He recently became the Founding Venture Partner for 1000 Angels in Boston because to him it represents the best platform for deploying capital into the private investment markets without the typical drudgery and duplicate fee structure common to other approaches.

Lead the efforts of a local chapter of 1000 Angels in your region.

Mr. Abraczinskas is the Founding Venture Partner in the Miami, FL region for 1000 Angels. Throughout his career, he has participated in Pre-IPO investments and provided early stage funding and guidance for several different Start-ups. Currently, he advises or sits on the board of directors for several different finance, tech, real estate, or eCommerce ventures.

At Archstone Capital Inc., Mr. Abraczinskas is currently Chief Investment Officer of a multi-family office with a vast portfolio of public and private equity that is primarily focused on tech, real estate, commodities and alternative investments. He oversees all capital allocation decisions for the fund of funds as well as the direct investment portfolio, and evaluates managers in asset classes including fixed income, equities and alternative investments. He has 16 years of experience in the dual track of Executive Corporate Finance/Operations (up to CFO/COO) and Family Office Investment Management (up to CIO) positions. His specialties include Portfolio Management, Corporate Finance, Strategy, Contract Negotiation, Accounting, and General Management, along with vast Corporate Operational/Financial diligence experience.

In his current role, Mr. Abraczinskas has full management autonomy as CIO, providing sourcing of deal flow, financing, transaction management and negotiation, marketing, investor relations, tax strategies, administration, compliance, and all back office requirements for the multi-family office. Mr. Abraczinskas utilizes over 12 years of direct M&A Experience to source opportunities, lead buy-side and sell-side transaction teams, and manage debt and equity financing efforts for angel investments and larger private equity buy-outs.

Darrel A. Branch is the founder and CEO of the Branch Out Group LLC, a marketing consulting firm that applies traditional marketing principles to help build mid-sized companies and non-traditional brands such as entrepreneurs, entertainers and athletes. The firm primarily serves as an out sourced Chief Marketing Officer to emerging businesses and enterprises. He also founded the Player’s Roundtable LLC, an invitation only investment and networking organization for high wealth individuals in business, sports and entertainment. Darrel is a C-Suite level executive with over twenty five years of global marketing and sales experience having served in integral senior leadership roles within several Fortune 500 Companies such as The Coca-Cola Company, Procter and Gamble and Revlon. Darrel brings an expertise in business that has earned him recognition at the highest levels of industry.

Darrel has been able to expertly translate his corporate experience and expertise in business and marketing to a successful entrepreneurial path, effectively facilitating business and investment opportunities across multiple industries such as health and beauty, technology, consumer products, hospitality and sports and entertainment.

As a management consultant and investor, Mary Jo has been actively involved in the healthcare sector for 30 years. Having sold a company to McGraw Hill, she has started and exited a number of organizations. In addition, she has been an active investor in early stage innovators in health care, and is on a number of boards reflecting that expertise. She is especially involved with health systems, physician groups, and payers who are migrating to next generation delivery approaches, using technology, evidence-based practices, and actionable data systems to improve access and quality of care nationally as well as globally.

Lead the efforts of a local chapter of 1000 Angels in your region.

Meet our Venture Partners